Protecting consumers, prosecuting criminals

Connecting the dots of public information so that voters have a full understanding of who they are voting for. If you don’t see the candidates discussing their financial interest from their own legislation, perhaps there’s a reason why.

What are MUDs?

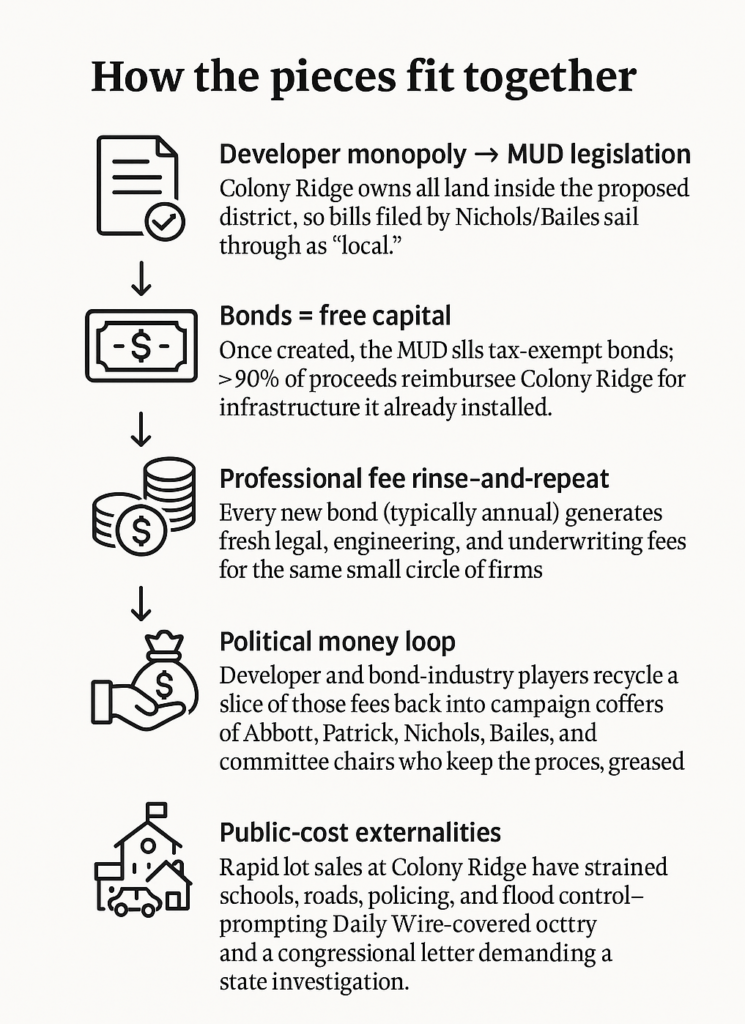

Municipal Utility Districts (MUDs) in Texas are special districts authorized to provide utility services, like water, sewer, and drainage, to a specific area. They are essentially independent, limited governments with the power to issue bonds and levy taxes to finance and maintain these services. MUDs are commonly used in new developments, particularly in areas outside city limits where municipal services aren’t readily available.

How are MUDs created?

MUDs are created through the Texas Commission on Environmental Quality and can also be created by passing MUD legislation in the Texas legislative body. The TCEQ process involves consent from a city or jurisdiction in order to be created. There must be an election of residence that live within the bounds of the proposed MUD in order to pass. That sounds noble but is there a way to insure this election goes the way it needs to for the developers?

Who gets paid to create MUDs?

- Politicians?

- Land Developers?

- Law Firms?

- Banks?

- Underwriters?

Who pockets the biggest dollars?

- Master developers

Receive direct reimbursement checks for roads, water & sewer—tens to hundreds of millions per project over 20 years.- Colony Ridge Land LLC (Nichols)

Johnson Development (both) - Signorelli Co. (Creighton)

- Colony Ridge Land LLC (Nichols)

- Bond-industry “A-Team”

- ABHR — 2-3 % of every bond sale as bond counsel + annual general counsel retainers.

- LJA / IDS / BGE — design fees & future construction-phase oversight.

- RBC / Hilltop / SAMCO / FMS — senior manager spreads and advisory fees each issuance.

Typical first-series bond: $15-30 M → splits $300-900 k among these advisers; repeat every 12-18 months.

- Operations & O&M contractors (post-buildout)

- H2O Innovation, regional operators, bookkeepers—smaller dollars but recurring forever (>$600 k / yr already in EMCMUD-7).

How are they used?

(MUDs) benefit developers by providing an alternative way to finance infrastructure, like water, sewer, and drainage, for new developments. Instead of developers needing to pay for this infrastructure upfront, MUDs can issue bonds to reimburse the developer for those costs, repaid through property taxes within the MUD. This allows developers to proceed with construction without the initial financial burden. Simply put, it’s FREE MONEY to Texas developers.

Who votes to create the MUD?

The “two trailer method” is a strategy, primarily used in Texas, to facilitate the formation of (MUDs) by circumventing the need for extensive community involvement in the initial stages. Developers can quickly gain control of a MUD by temporarily housing as few as 2 employees or “electors” within the proposed MUD boundaries, allowing them to quickly hold an election to create and control the MUD.

Big-picture patterns

- Self-reinforcing ecosystem: same developer → same counsel/engineer → same legislators → repeat bills.

- Opaque to public: “local & consent” calendar bypasses fiscal-note debate, so statewide taxpayers never see the bond-fee economics.

- Political alignment follows the money: ABHR and each master-developer appear in the senators’ top-donor ledgers within the same election cycle that their districts issue first bonds.

- Tax-burden transfer: early-stage buyers absorb high MUD tax rates that effectively refinance land-development costs—allowing developers to recycle capital into the next tract, perpetuating the cycle.

Put succinctly: developers collect the largest checks, but ABHR + a handful of engineers and underwriters quietly harvest a reliable, multi-decade revenue stream—while campaign donations flow back to the lawmakers who keep the pipeline open.